Checking Transactions

This guide assumes you have connected Parolla Plugins to your nominated Xero organisation, and that you have mapped the sales taxes.

Why Check Transactions?

Xero allows you to lock transaction dates using their Lock dates to restrict users from modifying or creating transactions before the nominated dates.

However, there is no facility for allocating bills/invoices/payments to particular date ranges for VAT3 filing. This means that if a transaction is modified after it has been filed with Revenue, then there is no automatic flag that notifies you.

How can Parolla Plugins help?

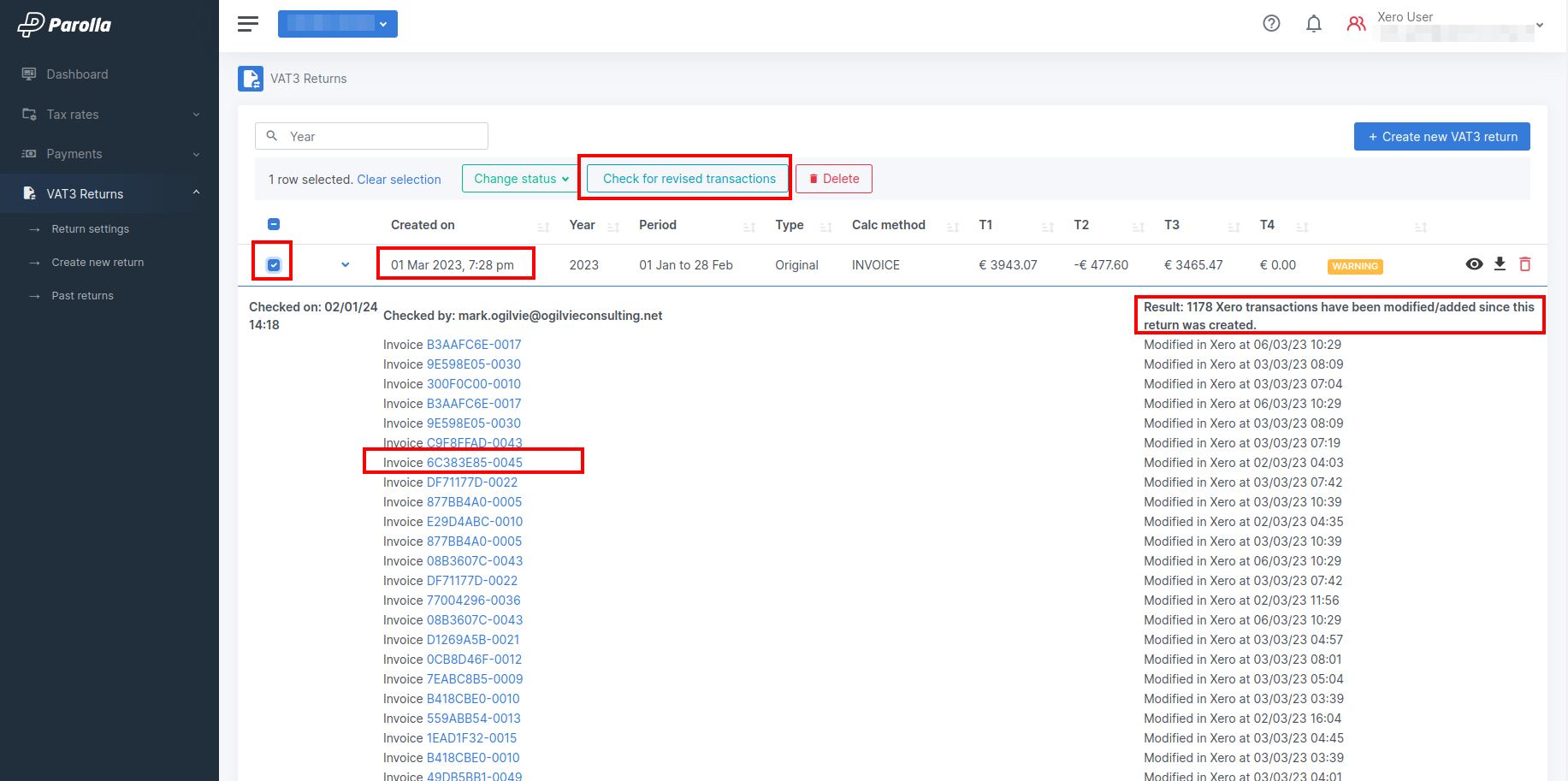

The VAT3 reporting tool has an function that will check the VAT3 return prepared in Parolla, and look for any Xero transactions that have been modified since the date that the report was run.

Once run, the function will create a list of transactions that were modified, complete with links to the Xero bill/invoice that was changed.

Some changes may be immaterial to VAT3. For instance, changing a line item description on an invoice, or the customer address. However, if the changes do materially affect your VAT3 return values, then you might choose to re-run the VAT3 return for that period.