Currency Exchange Rates And VAT

Parolla will identify the base currency of your Xero transactions and convert values to the reporting currency.

It should be noted that Xero uses Xe.com to convert foreign currency amounts to the company base currency. The hourly rate quoted by Xe.com is a mid-market rate, you can read more on this in the xero help files here.

The mid-market rate is the mid-point between the rate a currency can be bought or sold at during the period.

Note that the rules for Ireland are specifically outlined on The Revenue website. The foreign currency rate on sales invoices should be the selling rate recorded by the Central Bank on the date that the invoice is issued.

Foreign currency on a sales invoice

If you issue an invoice in a foreign currency, it must also show the corresponding figures in Euro. You should use the selling rate recorded by the Central Bank at the time the invoice is due to be issued.

By agreement with Revenue, you may use an alternative method for determining the exchange rate. This is subject to the condition that the agreed method must be used in respect of all your foreign currency transactions.

You should apply to your Revenue Office indicating the exchange rate method that you propose to use.

Foreign currency on purchase invoice

VAT becomes due on:

- the date of issue of the invoice, or

- if no invoice issues, on the 15th day of the month following the acquisition.

The VAT is payable in the VAT return for the taxable period that corresponds to the date when VAT becomes due.

The VAT is assessed on the price charged for the goods. If the supplier’s invoice is in a foreign currency, the rate of exchange applicable when the VAT becomes due should be used.

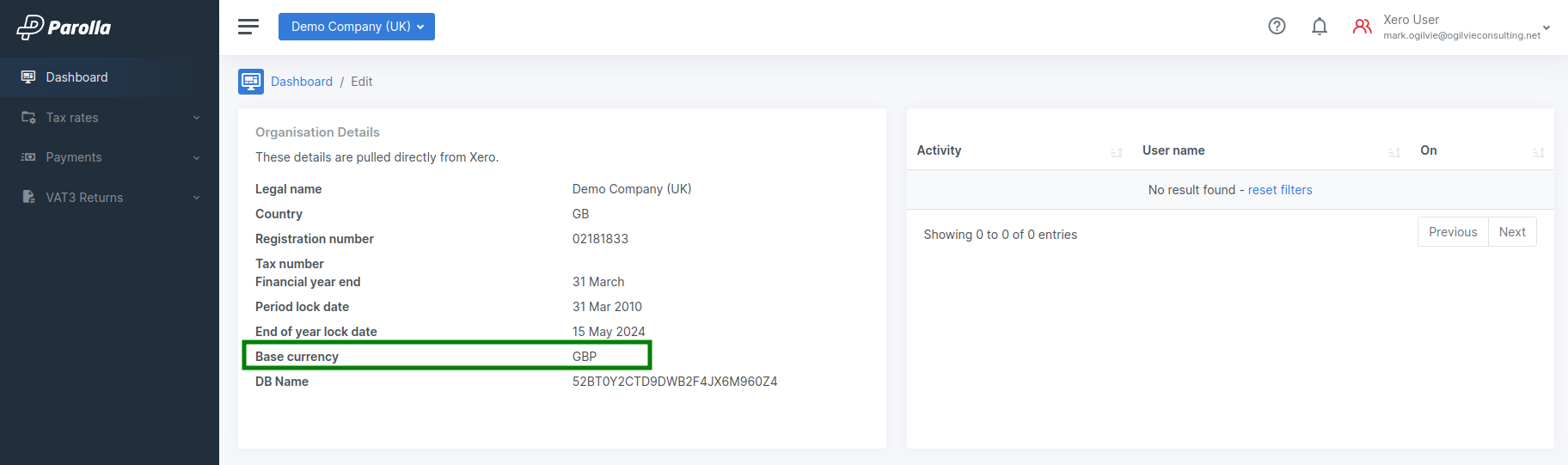

Identify The Xero Base Currency

Your organisation dashboard will show the base currency configured in your Xero account.

Conversions from Xero Base Currency

The VAT3 plugins function used the Xero API to get the transaction information from the Xero journals. These are all stored as a value of the organisations base currency.

Where the Base Currency is different from the reporting currency then we must convert the Journal values to the target reporting currency.

For transactions which were created in the reporting currency, then we apply the inverse currency conversion rate stored within Xero with that transaction.

For all other transactions we apply one of the two conversion rates below:

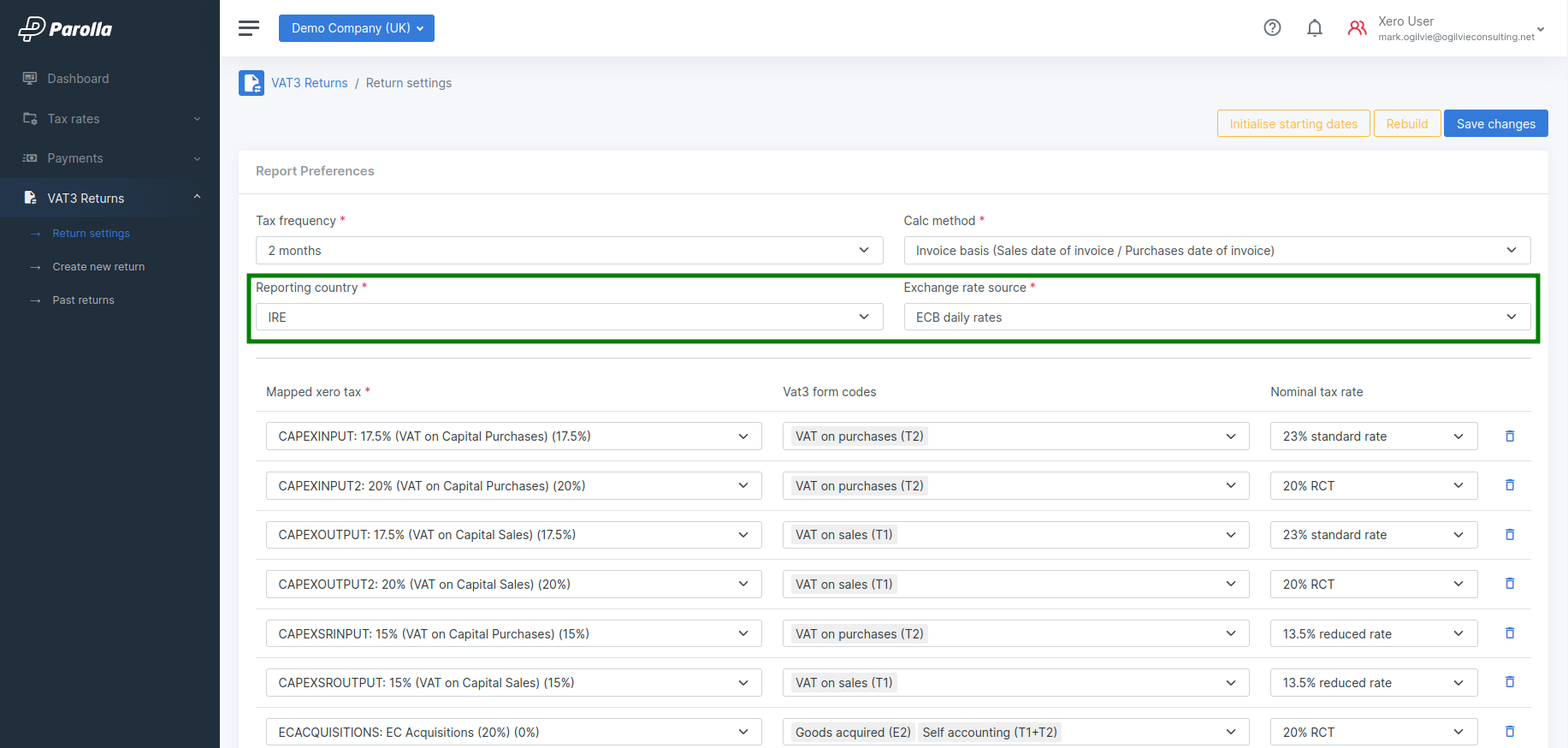

Preferred Currency VAT Return Settings

You can configure the target reporting country and the desired reporting currency in the VAT3 Report Settings page.

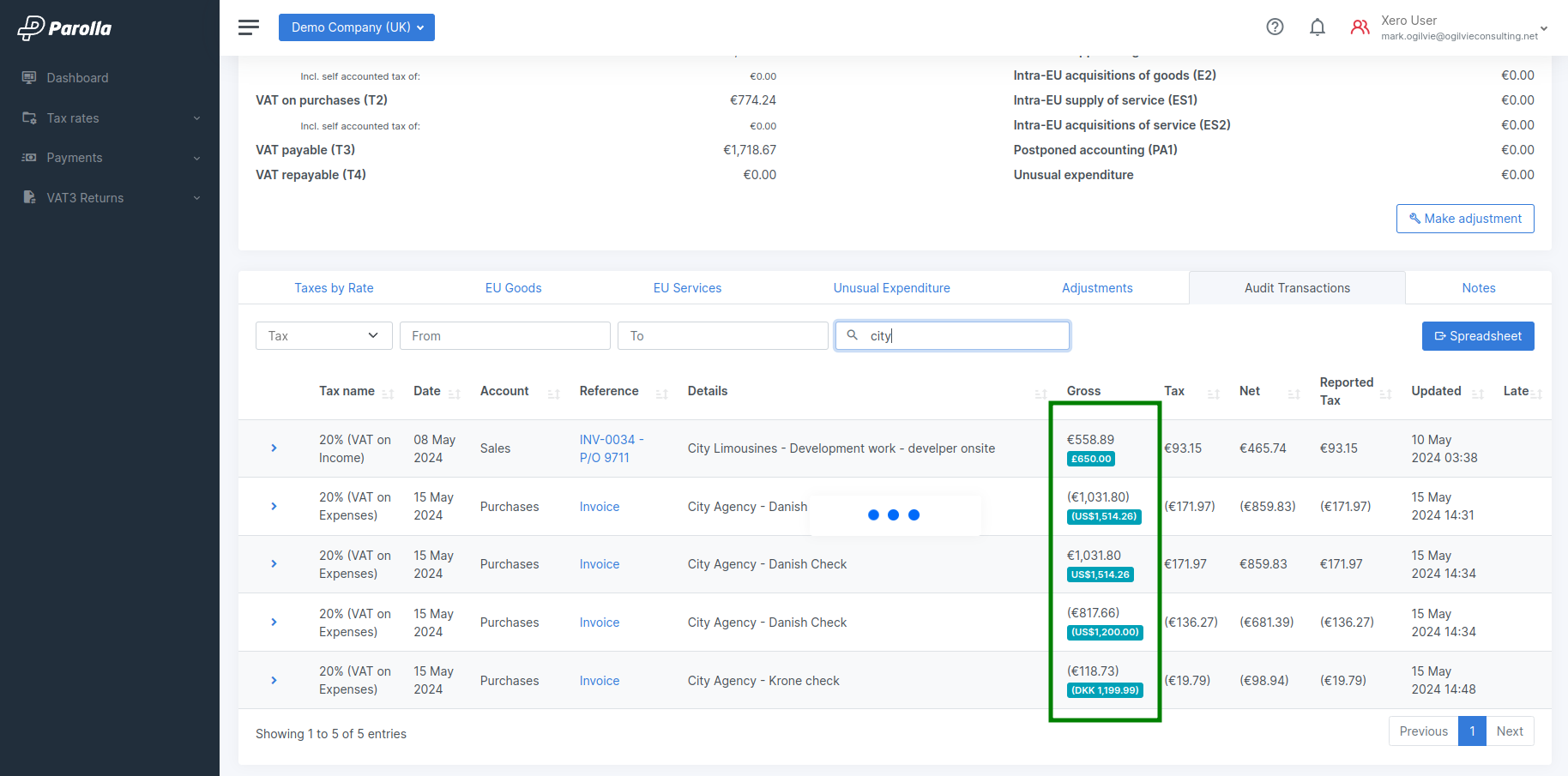

Transaction Currency

View the gross amount in its original currency in the Audit Transactions tab of the VAT3 Report.

Examples

Irish Global Edition Xero account reporting to The Revenue in Ireland.

All journal elements are stored in Euro already, no conversion takes place.

Any invoice issued in a foreign currency, say in USD, should be applied with an exchange rate via the Xero interface. Ideally you would apply the ECB rate at the time of issue. There is some slight difference between that and the default Xero XE.com rate. If the method is different from The Revenue recommendations, then seek authorisation and be consistent. Foreign currency invoices are converted by Xero and stored in Euro. No currency conversion is required from Parolla.

UK Edition Xero account reporting to The Revenue in Ireland.

All journal elements are stored in Xero as GBP values. Parolla will convert these to Euro using the selected method and the exchange rate on the day of the transaction.

Any invoice which were originally in Euro, will be converted from the Journal GBP value back to Euro at the inverse exchange rate stored with the invoice.