Running Returns

This guide assumes you have connected Parolla Plugins to your nominated Xero organisation, and that you have mapped the sales taxes.

Reporting Fields

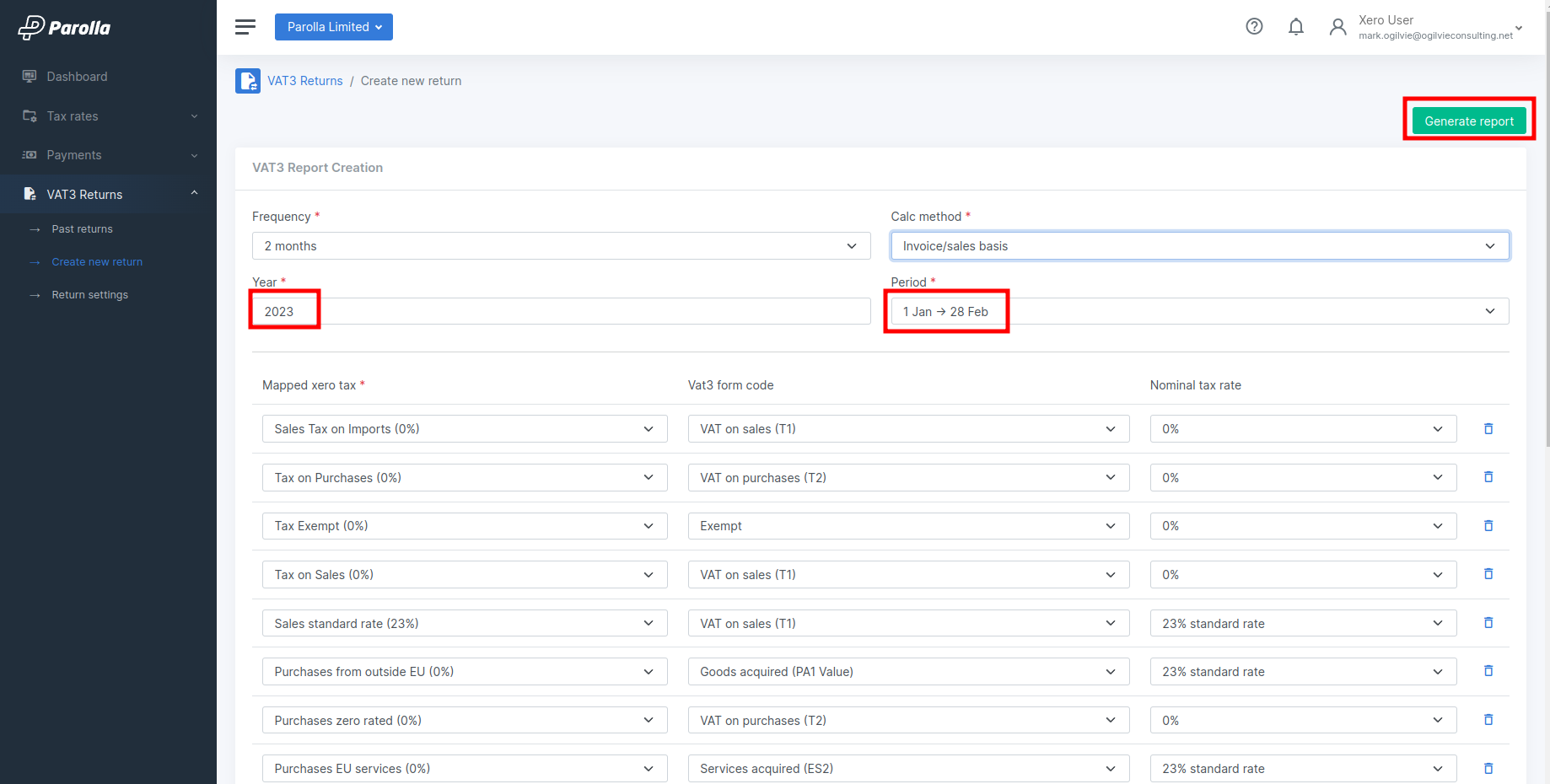

Most of the information required for running a report will be pulled from the setup that you completed earlier.

Frequency and Date Ranges

The frequency of the report is pulled from the reporting settings. You can override it in the individual report. Choosing Custom date range will allow you to define the start and end date for testing purposes.

The year of the report will automatically go to the current year, you can override that. You will then need to choose the period of the report. This changes depending on the Frequency that is selected above.

Calculation Method

If your company operates on a normal tax basis then use Invoice/Sales Basis

If your company operates on a Monies Received basis then use this option.

Testing

We strongly suggest that you test your configuration for the first couple of runs.

You can change the calculation method to sales or accrual methods to compare the Parolla Plugin output reports against the Xero Sales Tax reports.

Postponed Accounting

The plugin will identify transactions which have been mapped to the postponed accounting field and will pull those values from the line item.

Any duty arising from an imported product should be entered as its own line item in a bill to or payment.

All good and duty values will be added together into the PA1 field. The nominal tax on the imported goods value will be added to the T1 field.

Unusual Expenditure

Revenue keep a track of returns resulting in VAT repayments to the company. This may be entirely legitimate, such as with large capital plant purchases. The VAT3 report contains a field where you can declare any unusual expenditure, and hopefully avoid a Revenue verification check.

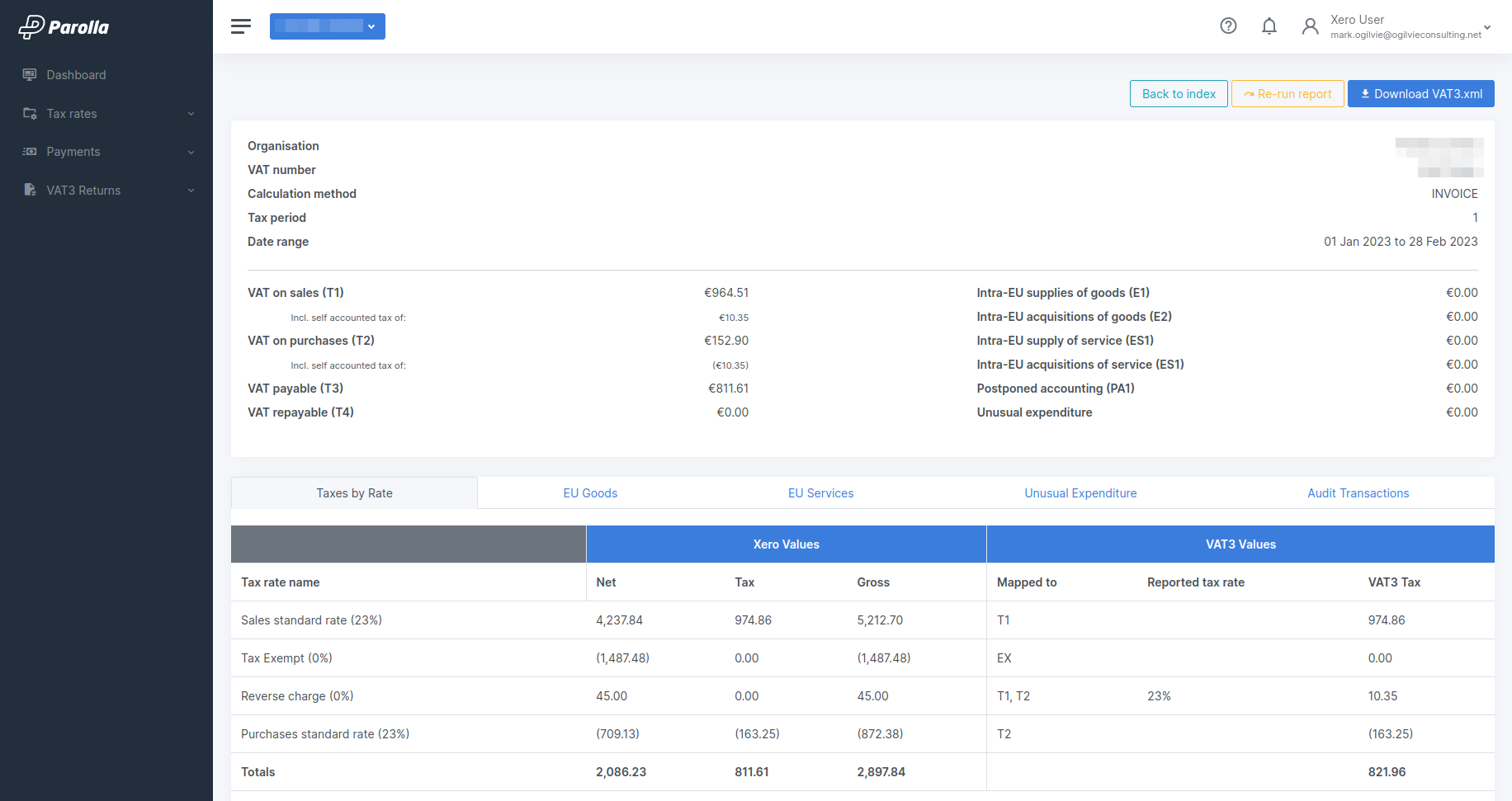

Report Output

VAT3 Returns

T1 – VAT on sales

This figure is the total VAT due on your:

- supplies of goods and services

- intra-Community acquisitions of goods

- import of goods, where you have applied VAT Postponed Accounting

- received services, as appropriate.

T2 – VAT on purchases

This figure is the total VAT which you are entitled to reclaim in respect of costs incurred by you on:

- goods and services, insofar as they relate to your taxable supplies and qualifying activities.

- intra-Community acquisitions of goods

- import of goods where you have applied VAT Postponed Accounting

- received services

- flat-rate addition.

Where you issue, or receive, a credit note, you may adjust the T1 and T2 figures.

T3 – VAT payable

VAT is payable to Revenue where the T1 figure is greater than the T2 figure. The amount payable is the difference between the two figures.

T4 – VAT repayable

VAT is repayable to you where the T2 figure is greater than the T1 figure. The amount repayable is the difference between the two figures.

T3 – VAT payable

VAT is payable to Revenue where the T1 figure is greater than the T2 figure. The amount payable is the difference between the two figures.

Where no VAT is payable, or reclaimable, in a tax period, the VAT 3 must be returned marked zero at T1, T2 T3 and T4.

E1 – intra-European Union (EU) supplies of goods

This is the total value of goods sent to customers in other EU countries.

E2 – intra-EU acquisitions of goods

This is the total value of goods sent to customers in other EU countries.

E1 – intra-European Union (EU) supplies of goods

This is the total value of goods received from suppliers in other EU countries.

ES2 – intra-EU acquisition of services

This is the total value of services received from suppliers in other EU countries.

PA1 – postponed accounting

This is the total of the Customs value of goods imported under postponed accounting, as per Customs Declarations plus Customs Duty.

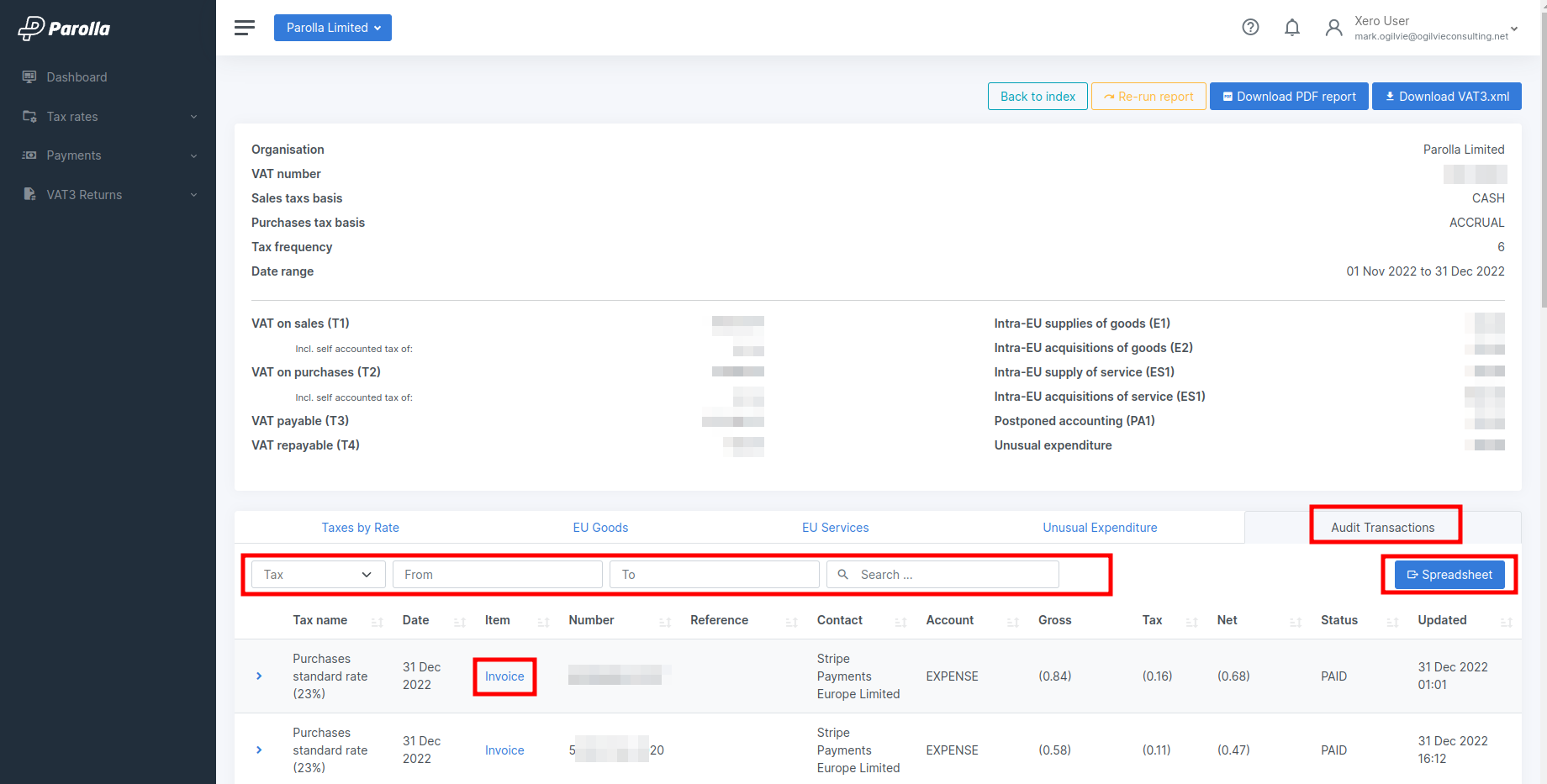

Audit Transactions

The last tab of the summary report will disply a filtered list of all the transactions that were applied in this VAT3 return.

The report filters allow you interrogate the report in detail. The transactions also contains links back to the original Xero item.

You can export the report as a formated and filtered spreadsheet from this page.