Late Transactions

Sometimes you may have a need to enter or modify transaction after the VAT3 return period has been finalised and reported to Revenue.

This typically occurs when:

- An invoice arrives late

- Bills are entered late

- Sales taxes are re-coded or modified

Parolla Plugins can identify late transactions that may have been added/deleted/modified in previous filed VAT periods.

Any late transactions will then be applied to the current VAT period when the report is run.

In order to make use of this feature, you must first define a start date.

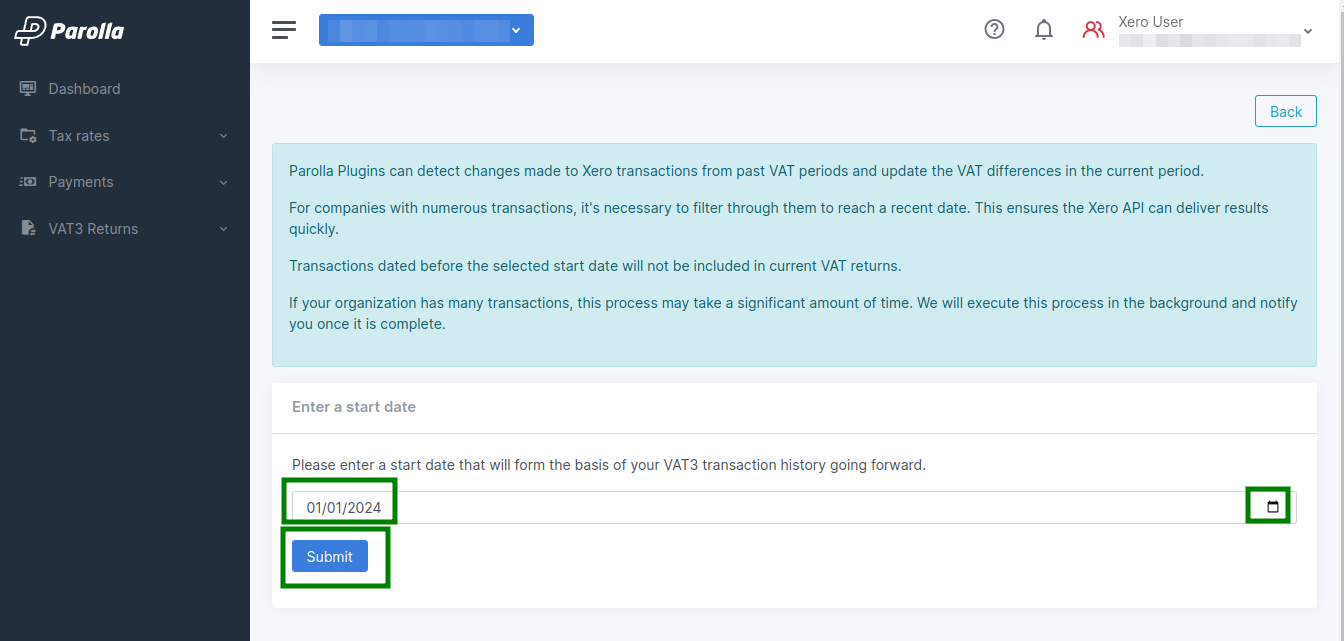

If you've been using Xero for a long time, or if you have a lot of transactions, then this process can take some time. We do this processing in the background, and if it takes longer than ten seconds we will send an email when competed.

How It Works

The initialisation process is a once off setup step. Parolla will start at the very first journal entry in your Xero account and skip forward until it finds the very first journal number falling on or after the start date. This becomes the start journal for any subsequent VAT3 returns.

When you create your first VAT return under this system, Parolla will start from the saved journal number and search through all subsequent journals and sort out those which are relevent for this period.

When you are happy with the first period VAT3 return, you must change it's status to 'Filed'. This stores the journal numbers with the VAT3 return, creating a marker for the next period.

Xero journals are created sequentially. If at a later date someone modifies a transaction, and a new journal is created, then the system will know that it has changed since the last return.

When it is time to run the next period VAT3 return, Parolla will be able to start from the last completed VAT3 return endpoint and will now be able to identify any late changes, bringing the values into the current VAT period.

A video tutorial can be found here.

Initialising the VAT3 Start Date

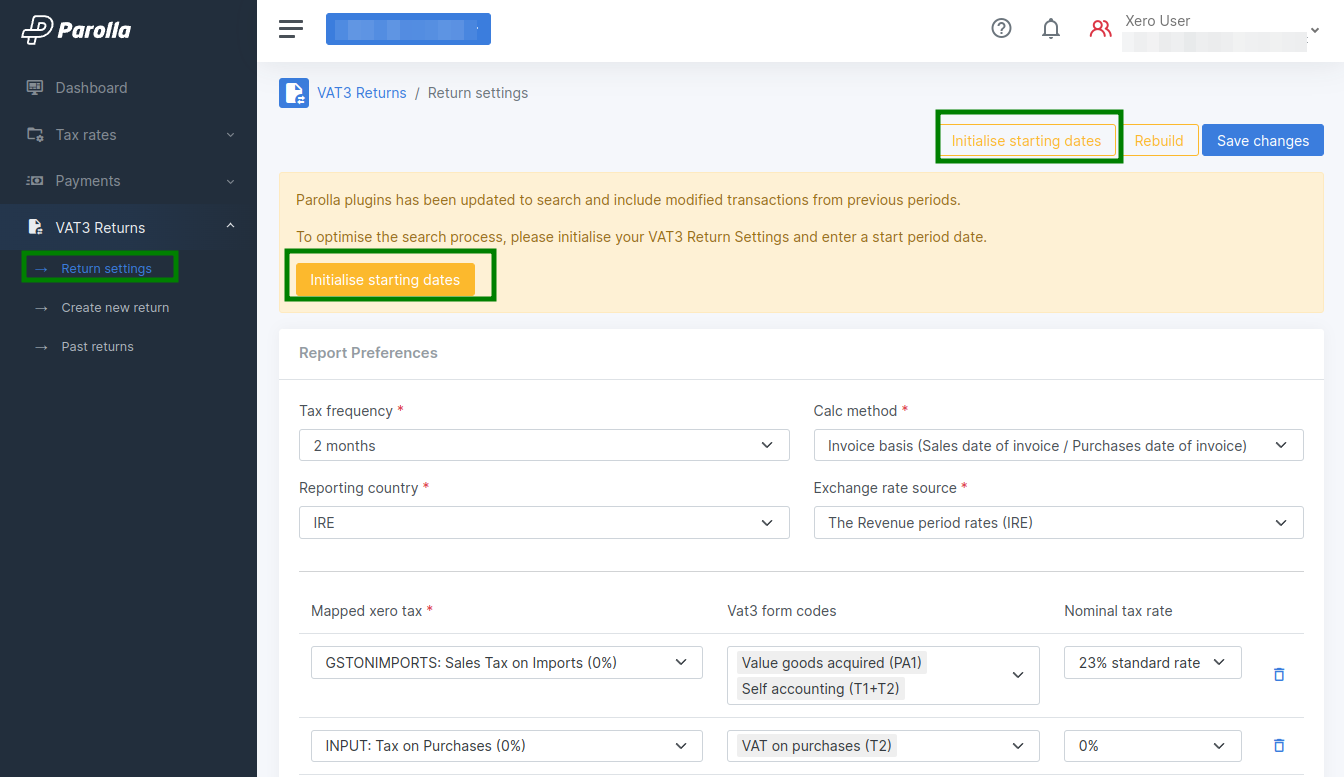

When you navigate to the VAT3 Settings page, or the Create VAT3 Returns page you will be notified. The same notification will also appear in the new VAT3 report page.

Enter a preferred start date that will form the basis of all journal queries. We suggest 1st Jan of the current year, or the first day of the current VAT period.

VAT3 Report Outputs

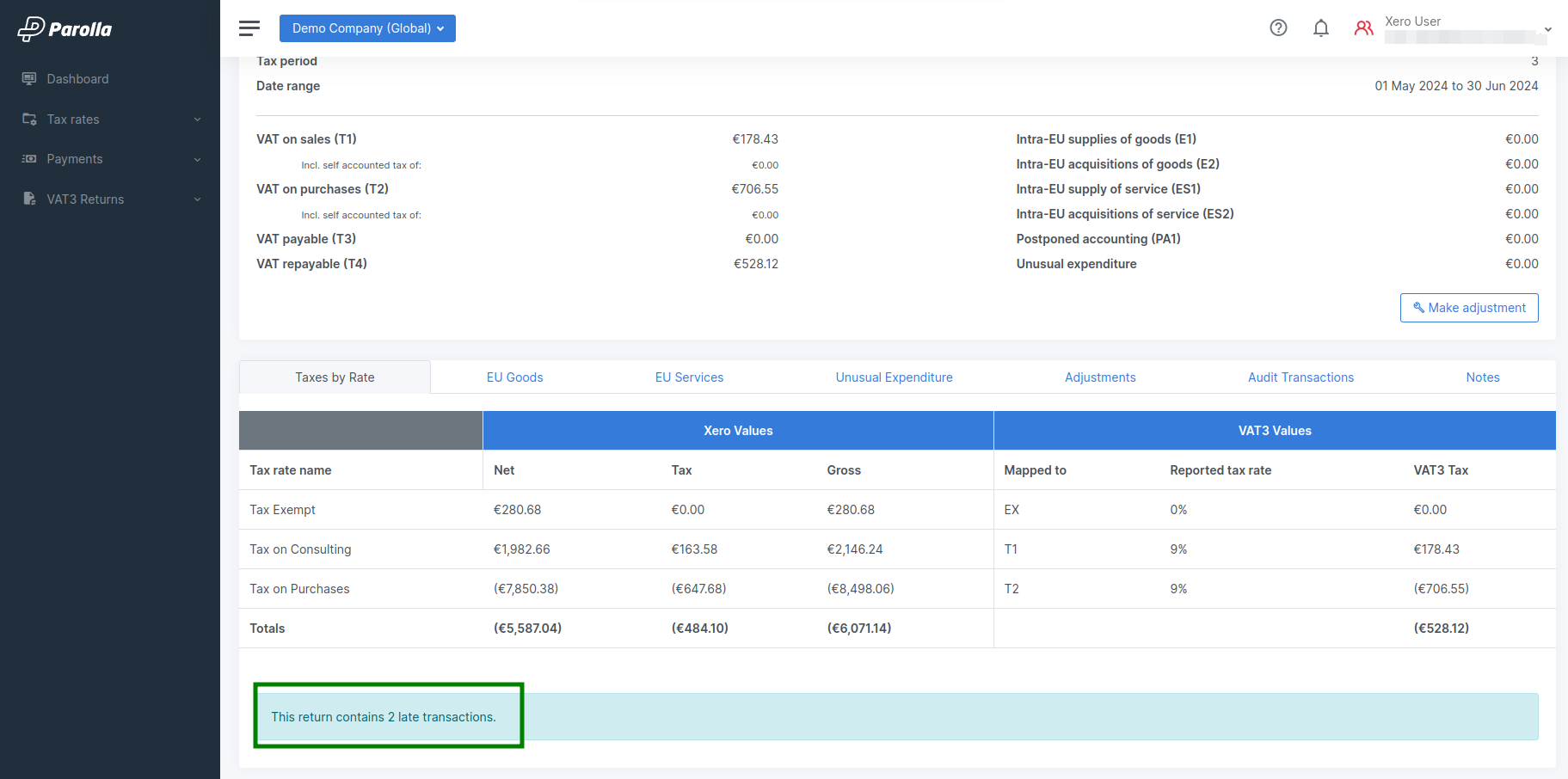

If there are any late transactions in the VAT3 report then there will be an information box at the bottom of the summary table.

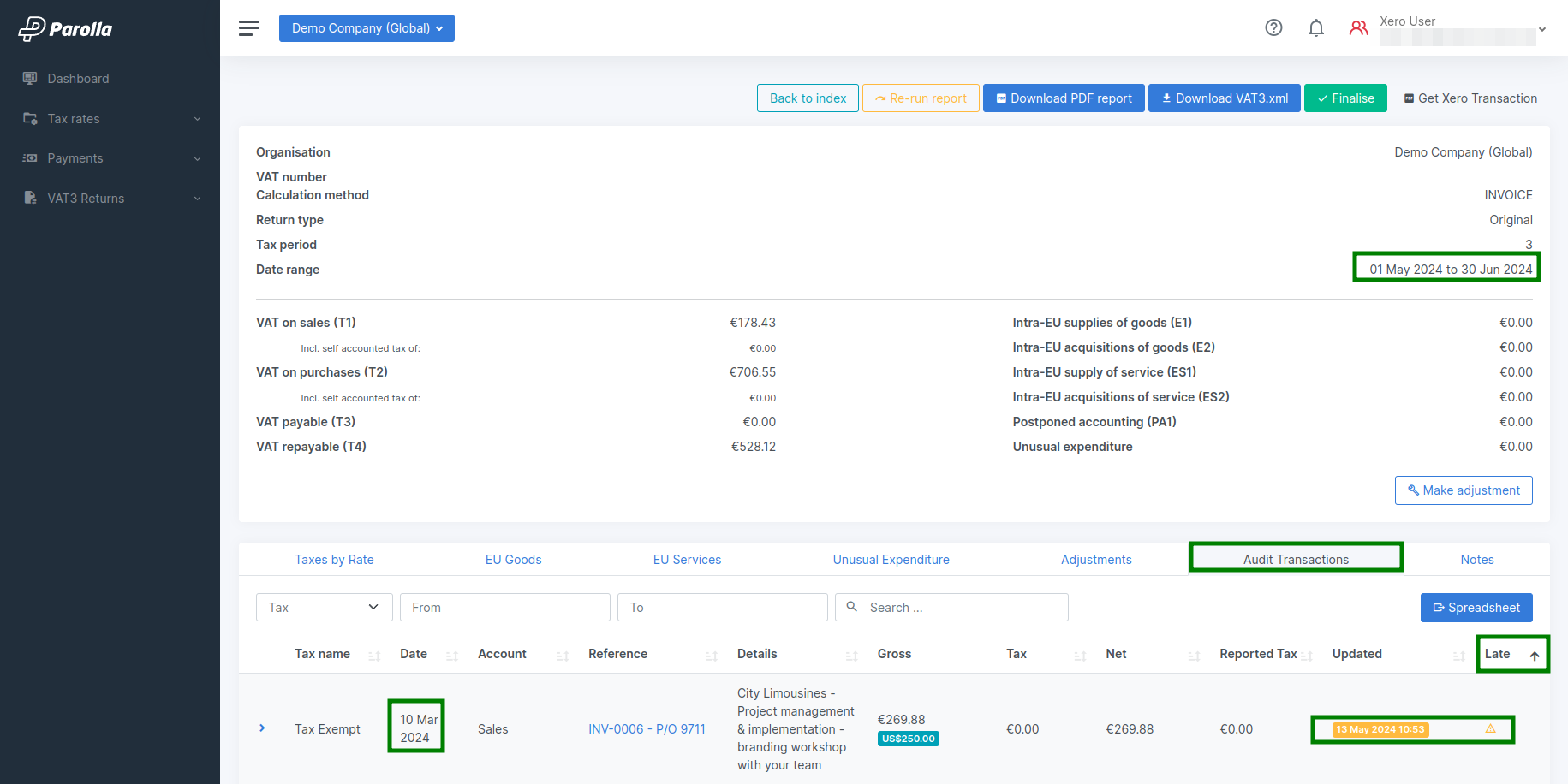

The individual transactions will be highlighted in the Audit tab. The Late filing column is sortable.

For example, the image above shows that the VAT report was for the period May/June, but that there is a transaction line that was modified on the 13th of May, and has a posting date in the previous VAT period on the 10th of March.