Map VAT3 Tax Rates

First, make sure that you have connected your Xero organisation to Parolla Plugins. See the guide here:

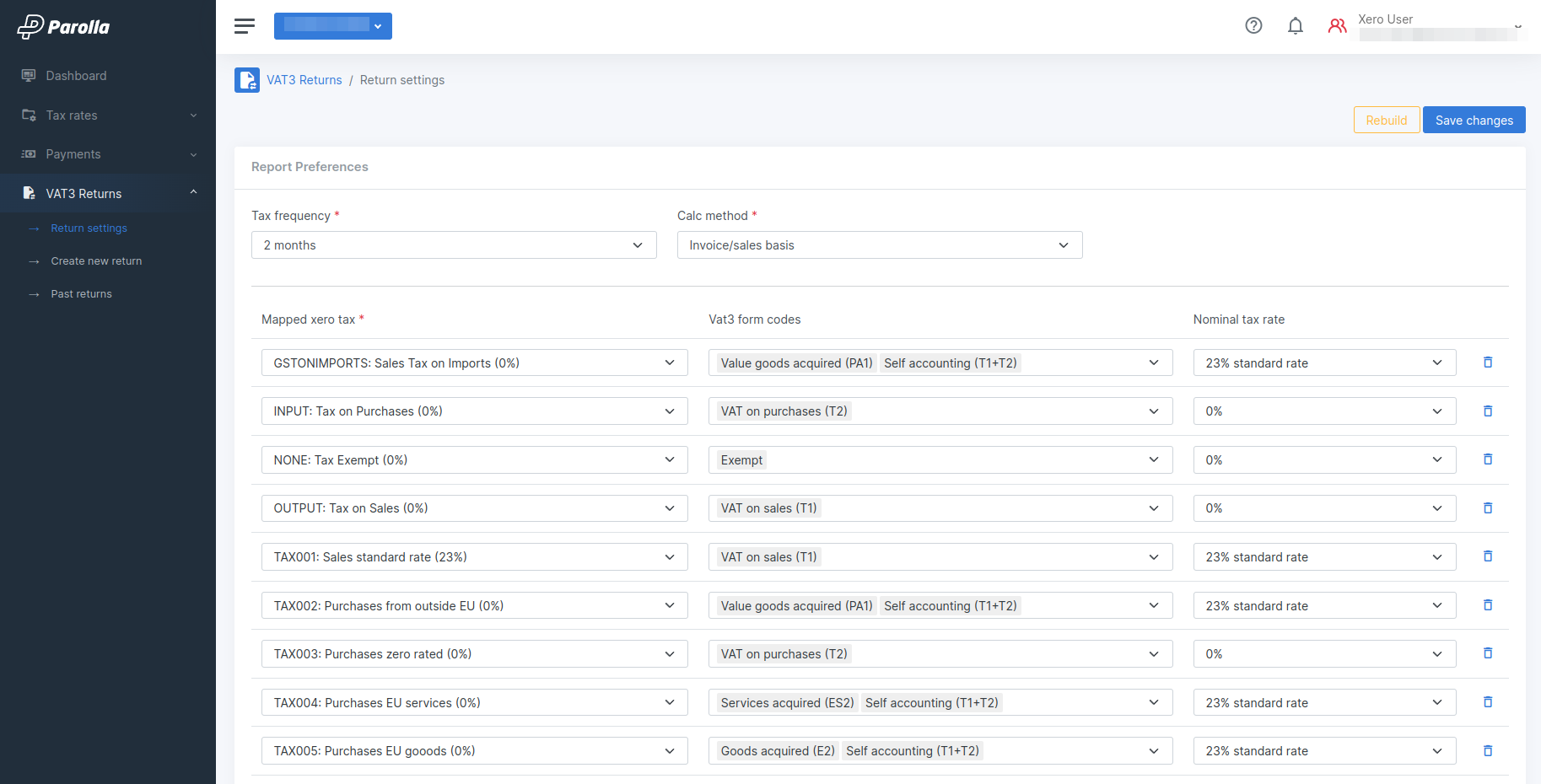

The next step is to map the Xero tax rates to the Parolla Plugins tax rates.

Definitions

- Tax Frequency: Choose the frequency that the company is scheduled to make VAT returns

- Accruals Basis: Tax is calculated on the date of the bill or invoice.

- Cash Basis: Tax is calculated on the date that payment is made.

- Invoice/Sales Basis: VAT3 is calculated on accrual basis for both purchases and sales.

- Monies Received Basis: VAT3 is calculated on accrual basis for all purchases and for Intra and Extra EU sales. Cash basis is used for domestic sales.

- Purchases Basis: Choose Cash or Accrual calculation method for all purchases transactions.

- Sales Basis: Choose Cash or Accrual calculation method for all sales transactions.

- Purchases Basis: Choose Cash or Accrual calculation method for all purchases transactions.

- Mapped Xero Tax: This is a column containing all tax rates in your Xero organisation.

- VAT3 Form Code: Choose which VAT3 field matches the Xero tax rate, (T1, T2, E1, E2, ES1, ES2 or exempt).

- Nominal Tax Rate: Choose to override the Xero tax rate and enter a different rate for reporting in the return.

Log into the Plugins application, and go to your page Select Organisation page.

Click on "Add Xero Organisation" in the top right corner.

How The Mappings Work

Parolla Plugins will initially scan your Xero tax rates and try to match anyting containing keywords like, "sales", "purchases", "goods", "services" and "EU". Where we can find a combination of those key words we will map the appropriate VAT3 reporting code.

In most cases EU, or reverse-charge, tax rates will be configured in Xero with zero tax rate. This is because there is no actual liability arising from the transaction. However, for reporting in VAT3 you should use the Nominal Tax Rate column to enter the rate of VAT that you want to report on the transaction.

When you run the VAT3 report the Parolla Plugins system will calculate and declare the value of tax associated with the reverse-charge transaction in both the T1 and T2 fields. It will override Intra-EU taxes an apply the defined Nominal Tax Rate to the value of the EU transaction, entering that value in both T1 and T2 files.

The actual value of intra-EU goods and service will be applied to the E1/E2/ES1/ES2 fields.

You should map all fields, even if they aren't being used at the moment. The mapping will be stored and used for all subsequent VAT3 reports by default. Although you can override the default mapping within the report if you require.

Suggested Mapping Rules

Local good and services:

- Exempt will not be included in the VAT3 return

- T1: Inward VAT collected on sales

- T2: Outward VAT paid on purchase

Intra-EU goods and service should be mapped to:

- E1: Value of goods supplied to the EU

- E2: Value of goods received from the EU

- ES1: Value of services supplied to the EU

- ES2: Value of services received from the EU

For transactions marked as intra-EU the system will add the value of the transaction to the E1/E2/ES1/ES2 fields in the form. It will apply the Nominal Tax rate (as entered in Parolla Plugins settings) to enter a VAT value in both T1 and T2.

Extra-EU imports of goods and service should be mapped to:

- PA1 Value: Value of goods imported into the EU.

- PA1 Duty: Duty applied to goods imported into the EU.

- Reverse charge: Services imported into the EU should be taxed at the local rate.

The value plus custom duty of the Extra-EU goods imported will be populated to the Postponed Accounting field PA1. The VAT arising from the value of the Extra-EU good imports will be calculated using the Nominal Tax Rate and then entered into both T1 and T2 fields.

The PA1 field in the VAT3 return should contain the value of the imported item plus customs duty. The Plugin tool will add the value of transactions with PA1 Value and PA1 Duty, but allow the user to override either if required.

If you receive services for business purposes from a supplier based outside the EU, you should usually pay VAT at the applicable rate in your country, as if you had supplied the service yourself (using the reverse-charge procedure).

Extra-EU sales of goods and service to outside the EU should be mapped to the regular T1, T2 or Exempt fields. Generally there is no VAT applied to these services.

VAT3 Calculation Basis

By default, VAT is calculated on Invoice/Sales basis, which means when the transaction is billed. Not when money changes hands.

Invoice/Sales Basis

VAT is normally calculated on the invoice/sales basis. This means that the liability will be computed by reference to the total VAT shown on the invoices issued in the two-month VAT period less the total VAT shown on the invoices received in that period. It does not matter whether payment has been received or made

Some companies can apply to The Revenue to file under Monies Received Basis, which accounts for sales transactions when the payment is completed.

Note that purchases, and that all Intra Community Acquisitions, are accounted for on a Invoice/Sales basis.

Who may opt for the moneys received basis?

You may apply to account for Value-Added Tax (VAT) in this way if you are a VAT registered person: whose turnover does not exceed, or is not likely to exceed, €2,000,000 in any continuous period of 12 months or whose supplies (at least 90%), are made to customers not entitled to claim a full deduction of VAT or who are unregistered for VAT. The second condition applies to sales by retailers, public houses, restaurants and any similar business selling mostly to private individuals.

Parolla Plugins Setup

If your company operates on a normal tax Invoice/Sales Basis then set both Sales Basis and Purchases Basis to Accrual

If your company operates on a Monies Received basis then set your Sales Basis=Cash and Purchases Basis=Accrual